Don't Miss

BitMart Announces Strategic Partnership with TokenInsight

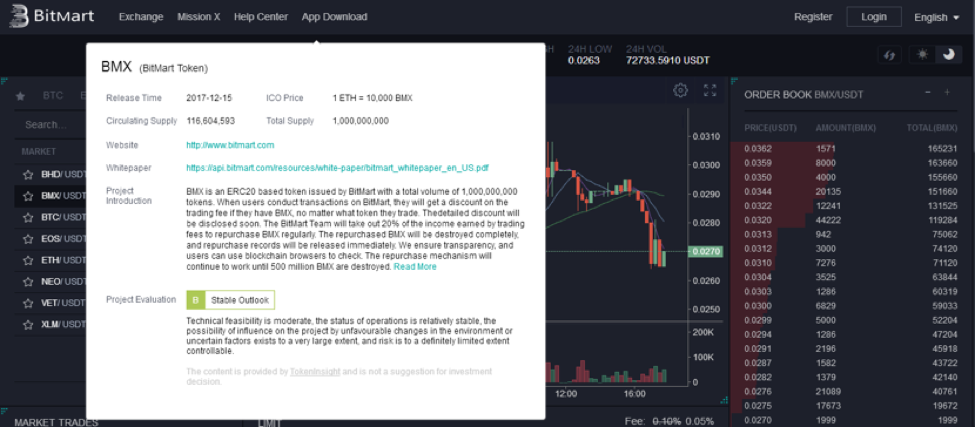

In an effort to create a more informative and transparent marketplace, BitMart Exchange recently announced their partnership with TokenInsight, a global token data & rating agency, regarding introducing project rating and reporting on a collaborative rating platform. This partnership will better serve BitMart’s users and clients in terms of making more informed trading decisions.

TokenInsight is an independent third-party rating and data analytics organization whose focus is to provide token evaluation and ratings on companies developing in the blockchain industry. “We’re really excited to be collaborating with BitMart as we feel that they are one of the most dedicated exchanges with a restricted coin listing process as well as an objective risk assess mechanism,” said Jason Ma, Global Partnerships Director of TokenInsight.

To ensure the fairness and transparency, BitMart also has top project analysts and a 7-member project review committee in their coin listing team. With professionals focusing on marketing, operation, technology, products and integration, qualified projects will obtain complete listing assistance including code review, technical docking and publicity preparation, etc. BitMart also conducts Vote for Your Coin campaign every month in order to engage more users as possible.

After launching the collaborative rating platform, BitMart will introduce the token rating and data analytics from TokenInsight to provide users with easier access to unbiased information.

“It is our hope to expand BitMart’s influence and research throughout the blockchain industry and to create a safer trading environment by introducing a third-party rating channel,” said Sheldon Xia, Founder and CEO of BitMart.

From now on, users can go to BitMart Exchange page and check project rating next to the status bar (shown below).

About BitMart:

BitMart Exchange is a premier global digital asset trading platform in the cryptocurrency market with over 503,000 users worldwide and ranked among the top 30 crypto exchanges on CoinMarketCap. BitMart currently offers 92 trading pairs with one of the lowest trading fees in the market. BitMart’s daily trading volume ranges from $30,000,000 to $40,000,000 USD and total trading volume has reached over $1,869,000,000 USD since launching in March.

BitMart has also announced two promotions including Mission X: The Community Listing Market and BitMart’s Registration and Referral Sign-Up Bonus program. To learn more about BitMart, visit their Website, Twitter or join their Telegram.

About TokenInsight:

TokenInsight is an independent third-party data analytics organization whose focus is to provide accurate information and ratings on companies developing in the blockchain industry. As we enter a new era of cryptocurrency technology, the relevant policies and markets surrounding this ecosystem have not yet been able to establish a fully regulated market.

TokenInsight seeks to establish institutional project assessment standards through a distinct framework of applied data science, artificial intelligence algorithms, and due diligence processes that result in accurate and insightful ratings. Through this process, investors and institutions will be able to better assess risks objectively with a comprehensive understanding of the projects and their potential. With our complete token database and advanced rating system, TokenInsight is to be the top resource for unbiased information that meets the highest standards of reporting.

Media Contact

Shirley Qian

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange