Don't Miss

Triggmine ICO White Paper Review

Our team took a look at the white paper of Triggmine, a company that’s drawing a lot of attention in the blockchain space right now. Here’s what we found and what it all means.

You can read the white paper here.

2018 has brought with it a whole host of companies looking to raise money through an initial coin offering (ICO) and, in doing so, has presented retail investors with an opportunity to pick up an exposure to the sort of startup technology to which an exposure wouldn’t have been available under legacy VC models in the past.

Of course, alongside this wave of companies looking to raise capital, the complexity associated with choosing the most potentially rewarding options for retail investors has increased.

Our team of analysts scours through white papers with the goal of identifying some of the top companies in this space and the latest one to attract the attention of our team is Triggmine.

With a view to serving up some clarity as to exactly what this company is trying to do and what it looks like from a value perspective, here is a review of the Triggmine white paper.

Introduction

As is often the case with these sorts of technical documents, the paper kicks off with an outline of the current state of the industry and, subsequent to this overview, details the problem that Triggmine is trying to solve with its product.

In line with this, we will start this review with the same.

So, conceptually at least, this one is relatively simple.

Triggmine outlines the fact that software as a service (SaaS) has essentially become the dominant and go-to technology across pretty much every aspect of the global industry over the last decade or so and is expected to continue growing for at least the next 10 years.

A major part of this is rooted in the ability for this sort of software to allow for the automation of certain processes that would otherwise be time-consuming and costly.

Specifically, and as an example of the growth in this space, Triggmine points out that the global marketing automation software market is expected to grow from US $3.65 billion in 2014 to US $8.61 billion in 2021.

Getting even more specific, Triggmine is targeting the automation of the email marketing process on which the revenue generation of a large number of companies rests and, notably, the company is further narrowing its target to focus on SMEs.

Why?

Well, and as explained in the white paper, large companies generally already use extensive email marketing automation solutions, which speed up the work of departments, reduce the HR factor, and save resources. However, small and middle-sized enterprises cannot afford to take this approach. Through a variety of factors, including complexity, time, cost and more, SMEs just don’t or aren’t able to match the automation processes that their larger counterparts leverage so effectively.

And this is where Triggmine comes into the equation.

The goal

Here’s the blurb:

“The Triggmine team has created a truly intelligent system that not only automates email delivery but also adjusts to the ever-changing business parameters and individual characteristics of each customer. This has become possible due to the technologies they have implemented in their solution: AI and blockchain.”

Essentially, then, the company is saying here that its solution will allow SMEs to integrate and leverage the same sort of technology that larger companies do right now as relates to email marketing without the issues mentioned above hindering implementation or execution.

The technology harnesses what the company refers to as an intelligent system, which employs a neural network-type process to target offers at potential customers depending on certain trigger factors, each of which is unique to the customer in question (demographics, location, that sort of thing).

We said that conceptually this was relatively simple but, when you take a little bit of a deeper dive into exactly how things work, there is a degree of complexity associated with this company’s product.

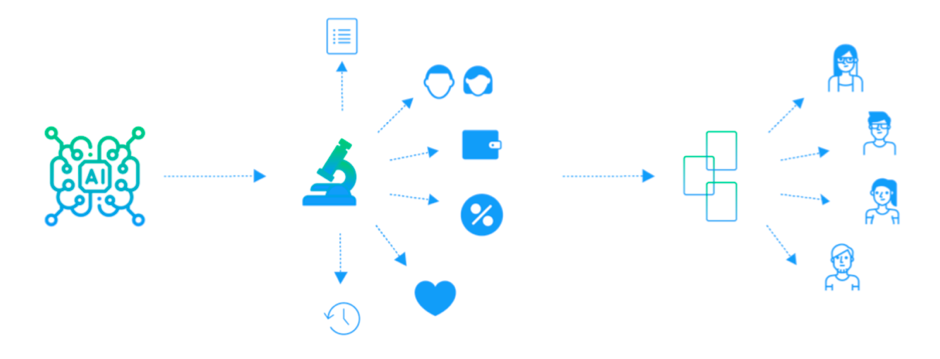

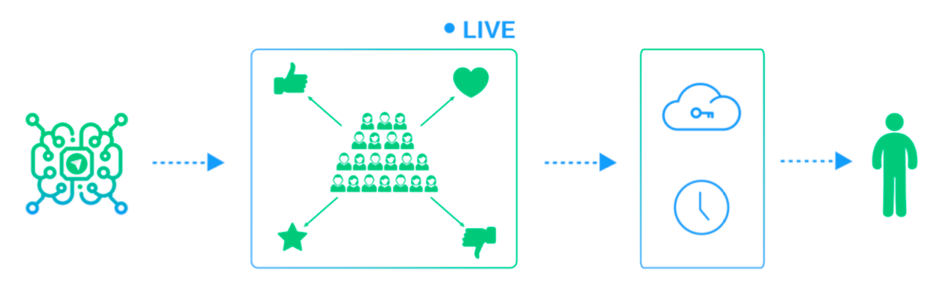

Take a look at the images below, pulled directly from the white paper.

The above image shows the way that the AI works to identify certain unique characteristics associated with potential customers and then structures and email marketing campaign to accommodate these characteristics and, in turn, to maximize the potential for conversion as the campaign matures.

The second image illustrates a similar concept to that above but also demonstrates the impact of a neural network effect on the efficacy of the marketing campaign and the ability for the AI system not just to target individuals based on certain characteristics but also to arrange for a specific delivery sequence and timing characteristics.

So that’s what this is all about.

How does everything work?

Well, the next part of the white paper discusses exactly that.

How does Triggmine work?

The system employs smart contracts built on a blockchain which allows for the complete automation of the standard email marketing process without the requirement for human intervention.

The smart contract contains all of the necessary information about the scenario of development of each business, which is based on:

- benchmarks

- business stage

- industry

- the quantity of user data

- information about recurring sales

Alongside the smart contracts, artificial intelligence technology is able to collect and process data so as to coordinate an optimal campaign and to subsequently execute on this optimal campaign by employing the just mentioned smart contract technology.

As per the white paper, there is a five-step AI-based algorithm that underpins Triggmine and it is described as follows in the document:

- Business stage identification. This includes an analysis of benchmarks and the subsequent determination of the deviation from average in a given store.

- Define KPIs in the context of benchmarks, and further in the context of a given industry. This includes the quantity of traffic, new customers, resale, average order size, churn rate, and a winback rate.

- Find out how much Triggmine can improve the business. With this, the obligations and conditions for achieving these indicators are included in a smart contract.

- Payment for the service is fixed in a smart contract and is withheld until the contract is completed in favor of the service or the client.

- The conditions above are sent to the back-end, where for each of the specified items in the contract, it is determined whether the condition was achieved or not achieved, and the determination of the winning side is made (service/client).

So that is a general overview of how things work and what problems the company is trying to solve, and, to this point, we feel that the white paper has done a pretty good job of putting forward the value proposition. However, we feel that Triggmine could be a little more specific as to exactly how it’s software and technology can benefit the company’s customers, and, to its credit, the white paper outlines exactly this in the next section.

The Value Proposition – Client Side

The value proposition is broken down into three different client types. The first of these are business owners, which (we assume) will be the company’s primary target market and, more specifically, small to medium enterprise size businesses.

The value proposition here is rooted in the ability of the software to conduct effective email marketing campaigns without the necessity for human intervention, meaning the business owner has more time to conduct the other important and revenue-generating areas of operations associated with his or her company.

The second value proposition is rooted in traditional contributors.

As is pointed out in the white paper, new technology in a fast-developing field can be an excellent long-term contribution. The adoption of artificial intelligence is still very much a grassroots movement, and the problem of email marketing, which Triggmine solves at the same time, is an indication of the prospects for continued development and enduring interest in the project.

Finally, the additional value of the project is available to cryptocurrency users.

Again as highlighted in the white paper, cryptocurrency projects have become mainstream, and finding a unique one to contribute to is even harder, as they rarely differ from one another. Triggmine stands out from the pack by combining an AI-driven solution and AI-based blockchain technology.

Here’s how the company closes out this section: for Triggmine, cryptocurrency is not a target, but a means.

What’s our take on this then?

Well, we like that the company has recognized the areas in which it can offer the most value to each of the different target markets in the space. At a glance, it may seem like the company is being too targeted in its approach and, in doing so, limiting its potential for revenues. However, all too often in this space, we see a company overstretch with its target market and, at the same time, overpromise when it comes to revenue potential. Triggmine is being somewhat conservative in its approach to this potentially very large market and this is a strong point in the white paper for us.

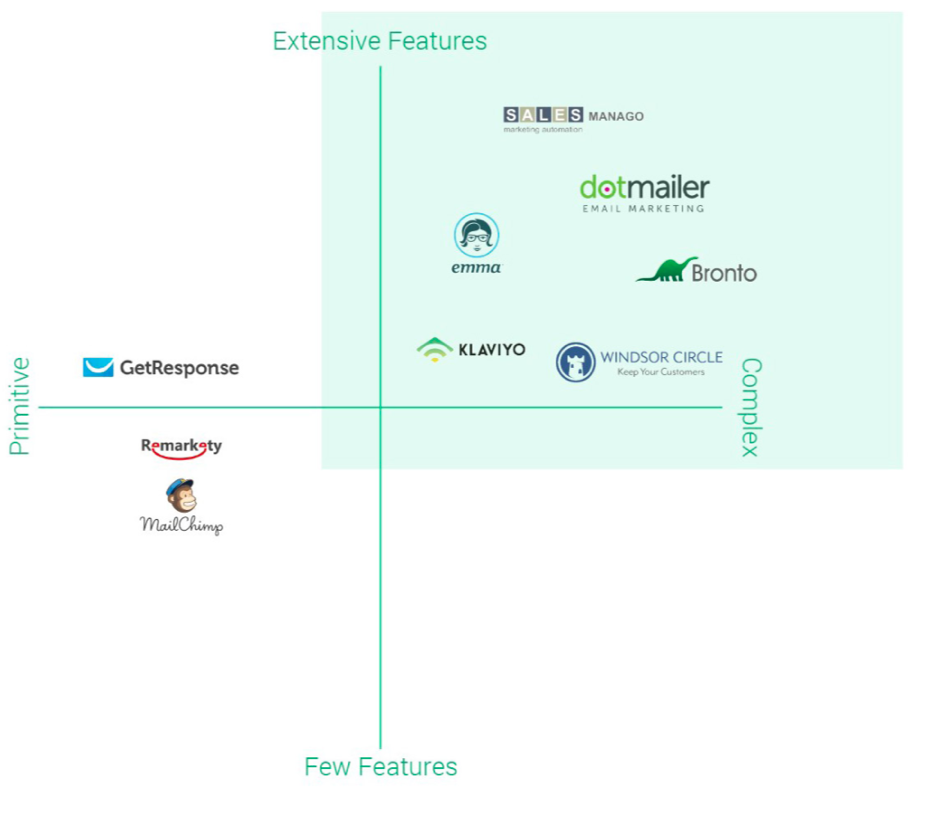

Before getting into the next section, Tokenomics, here is what we see as an important image:

This image was taken from the white paper and it illustrates the competitive landscape that Triggmine is targeting right now. Essentially, it highlights the fact that none of the existing solutions offer what we might refer to as a happy medium between features, complexity, and regular updates. It’s this happy medium that Triggmine is trying to achieve.

Tokenomics

The company is going to use a token called TRG, will be created only in the process of the token sale. We like this approach as it ensures that the value of the TRG offer will be fixed only after the end of the token sale and that, subsequently, it allows for the remaining unsold tokens to be burnt, fixing the initial supply.

From a value growth perspective, that’s a very strong approach in our eyes and it is one that is a real take in the box for this company as a potential allocation at ICO stage for a retail investor.

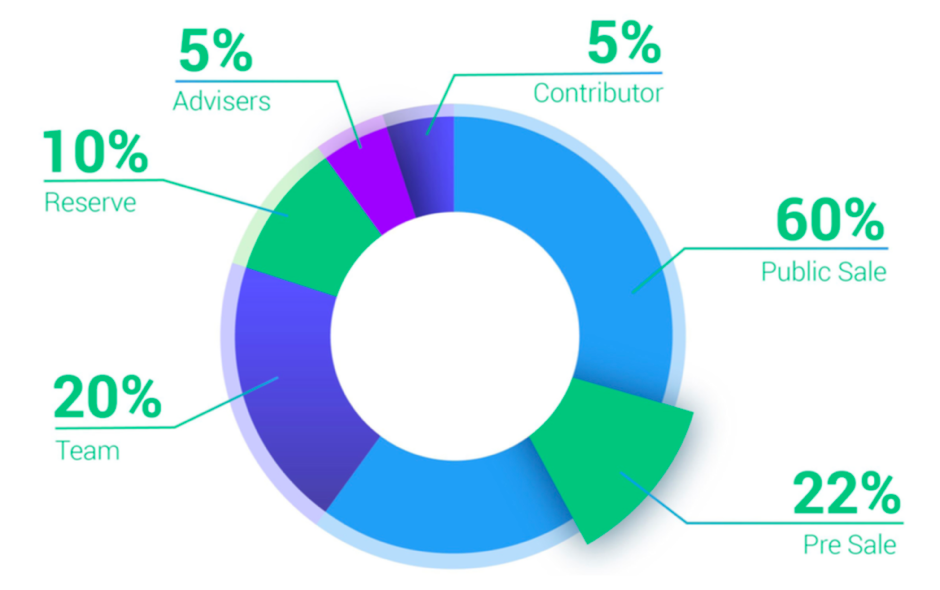

The image below details the distribution of the tokens from the outset:

And the below statistics, taken directly from the white paper, offer some insight into the metrics associated with the issue:

Pre Sale (March 2018)

- Triggmine tokens distribution cap: 18 000 000 Triggmine tokens (1 800 ETH) Minimal goal to start: 5 000 000 Triggmine tokens (TRG)

- Cryptocurrency accepted: ETH

- The token’s price: 1000 TRG = 0.1 ETH

- The minimum purchase amount: 0.1 ETH

- Amount of tokens per one person: unlimited Minimum transaction amount in Ethereum: 0.1 ETH Maximum transaction amount: unlimited

Public Sale (June 2018)

- Triggmine tokens distribution cap: 60 000 000 Triggmine tokens (6 000 ETH) Currency accepted: ETH, BTC

- Amount of tokens per one person: limited

- Minimum transaction amount in Ethereum: 0.1 ETH

- Minimum transaction amount in Bitcoin: 100 Triggmine tokens Maximum transaction amount: limited

There are also bonuses available for early participants, which we think should serve to strengthen the campaign at kickoff. These bonuses start at 20% on the first day of the sale and decrease to 15% as the sale matures.

Conclusion

So what is our take on this one?

Altogether, we think this is a very strong white paper.

This company is trying to tackle a market that is right for disruption and it already has a product in place that it can use to underpin these efforts. The fact that the product exists already (as opposed to it being developed using funds raised in the ICO) really helps this one stand out and should strengthen Triggmine in the eyes of potential investors between now and the end of the sale.

The company is being aggressive in its milestones and its strategic roadmap but a degree of aggression is fine, so long as it’s also realistic in that there is a product and a team supportive of growth potential associated with the ICO.

And in this instance, there very much is.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange