Blogs

Bitcoin, Litecoin, and Ripple still deserve real fondness, here is why

April was fantastic for cryptocurrency trading. All coins went up. Things seemed just peachy. But last week was not that good as most coins lost some value against the USD. Take Bitcoin. It’s currently at $7365 against the dollar when it was beyond $8500 just a week or so ago. It is its lowest point since last April 18th when it was close to breaking the ten thousand barrier, and the market was all about rising prices. Bitcoin’s market capitalization is now at 126 billion, and it remains the biggest slice of the pie with a thirty-nine percent dominance.

Fears about Bitcoin are just identical as with all other main crypto coins such as Litecoin (LTC) or Ripple (XRP). XRP has gone down by 0.34% over the last twenty-four hours, and 13% in the last week so it’s now at $0.60. Litecoin has found itself in a similar situation as it’s lost 0.18% in the last day, and 15.29% for the week – so it’s now at $117.9 USD.

The Consensus 2018 conference a couple of weeks ago was supposed to prompt a market comeback that has not happened yet. Even as this is happening, observers are still predicting a market rally that will see Bitcoin and other digital assets reach new historical highs.

Projections, studies, and analyses all agree on that, so investors should not be worried about the current lows, but financial markets have never been driven by rationality anyway. It seems we’ll just have to wait until the wind changes again, and we can all ride the bear back to the top.

Even in the current context, there are good reasons to stay optimistic about Litecoin, Ripple, and Bitcoin.

Bitcoin (BTC): The power of permanence

Bitcoin has the name. It was the first cryptocurrency ever and it remains the one coin that holds the greater status, value, and demand. It’s been criticized by governments and observers, it’s been at the center of most scandals in the crypto world, it’s slow, the transfer fees are too expensive and, even when you take all into account, Bitcoin is still Bitcoin. It’s been around the longest, and it’s most certainly here to stay.

Every other cryptocurrency owes its existence, at least to a point, to Bitcoin and it remains the safest option around.

Besides the fact that it can be used for payments and for storing value, BTC has shown incredible resilience, it always recovers its value back, which is why Wall Street is getting involved with it. If cryptocurrency apocalypse were to happen today, there’s a ninety percent chance that Bitcoin would stick around anyway.

So don’t bet against Bitcoin. It is going to stay around as long as there’s a crypto market. It has demand and as its network is scheduled for an upgrade. It can only become more valuable.

Litecoin (LTC): Growing quietly but steadily

Whatever else is happening with other alt-coins, LTC retains some kind of charm that is allowing it to be increasingly accepted everywhere around the planet. As Bitcoin becomes more of a means to store wealth, Litecoin is becoming a retail payment currency the world over. As more businesses accept it as a payment option and more people use it to buy goods and services, its demand and value can only increase.

Ripple’s XRP: Partnerships matter

From all three coins mentioned in this article, Ripple’s XRP is the one having the hardest time. Questions remain about Ripple Lab’s role in controlling (or not) the coin’s performance, and there’s the issue of the lawsuit (is it a security or not?) that could affect every coin in the crypto world.

But the fact remains that, even in that context, Ripple is the one cryptocurrency that has proved it has practical value in the real world as at least seventy-five banks in the world are now using it to do their international transactions. There is every chance that the financial world will radically change because of Ripple’s technology and Ripple’s coin.

Ripple’s xRapid has gained acceptance among many big players in the financial sector (Western Union is one of them). It’s shown it can make international payments quicker, cheaper and more reliable. This is making XRP entrenched in the real world. There’s demand for it and Ripple’s technology customers need it.

Last thoughts

The market is down at the moment; there’s just no doubt about that. But it will bounce back for sure and when it does these three coins will be leading the way to recovery. So don’t panic, just wait a bit.

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pxhere.com

Altcoins

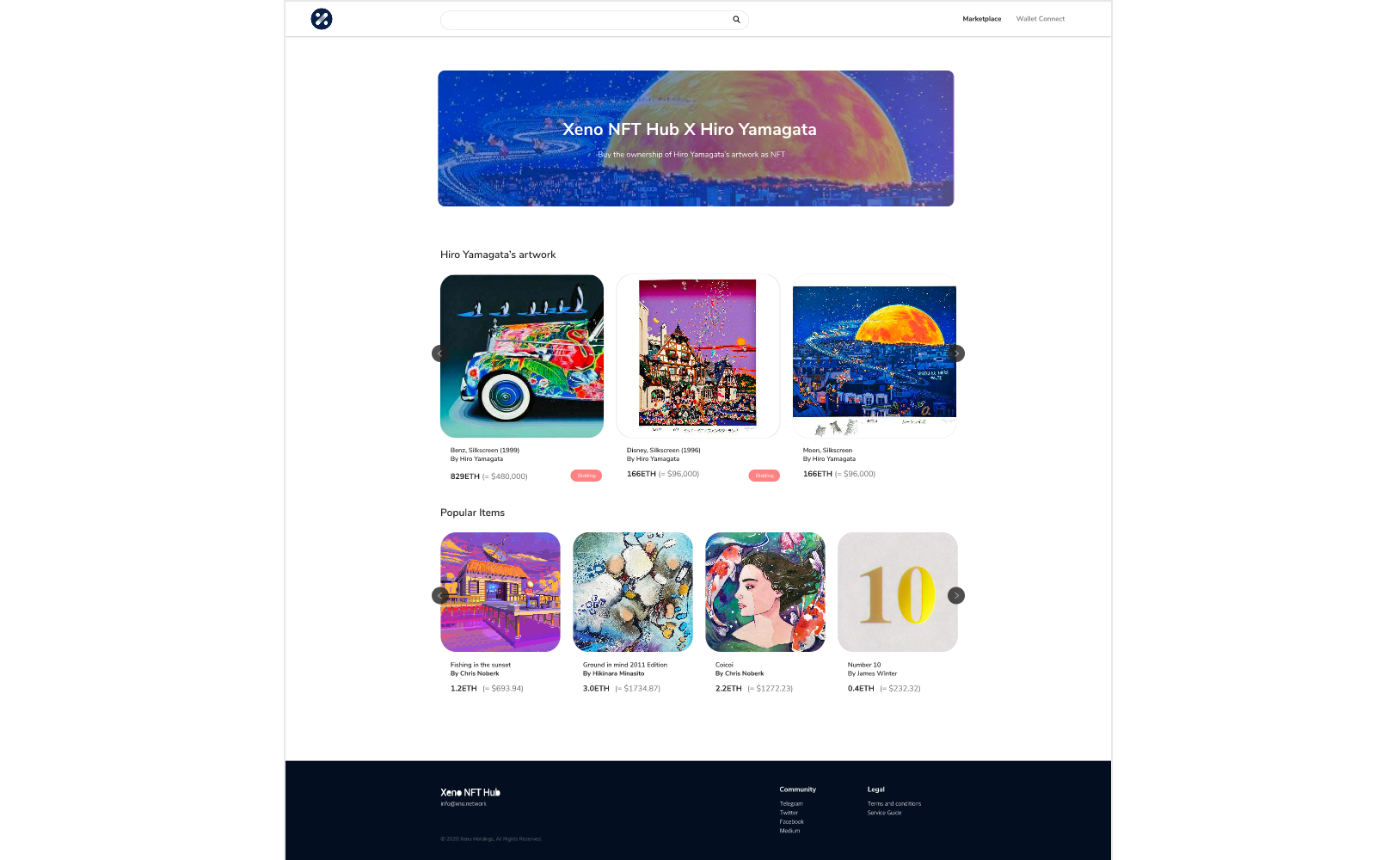

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

Should Crypto Projects Devote Resources to Community Growth and Marketing?

2020 has been an incredible year for crypto as investors have generated windfall profits and crypto projects have seen their businesses gain the spotlight they’ve been looking for. While Bitcoin has received most of the attention after major institutional investors announced they were accumulating the increasingly scarce asset, many altcoins have also seen their fair share of glory. When looking at all the big winners of the past year, the first project that probably comes to mind is Chainlink, having appreciated by more than 550% YTD and now valued at over $4.5 billion. But, the actual biggest winner of the year is HEX with a YTD return of over 5,000%.

I mention both of the above projects as they have each taken slightly different paths to achieve greatness. Chainlink has devoted resources toward building a fundamentally sound business with many strategic partnerships while HEX has spent vast sums of money on marketing and promotion. Both approaches are valid, but one thing is certain, it is absolutely imperative for crypto projects to let the crypto community know what makes them special. Of course, one of the reasons that makes crypto so valuable is the powerful blockchain technology that most projects are utilizing.

Cryptocurrency vs. Blockchain Technology

It’s important to make a distinction between blockchain technology and cryptocurrency. Although they are often used interchangeably, they are different. Blockchain technology and crypto were both created after the 2008 financial crisis, but cryptocurrency…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?